extended child tax credit portal

The first one applies to. Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

. Money from the credit will be split. This year Americans were only required to file taxes if they. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

4 1 Amount increase 0 500 1000 1500 2000 2500 3000 3500 Previous Child Tax Credit. Not everyone is required to file taxes. Researchers say it could.

Congress fails to renew. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. A childs age determines the amount.

Tax Changes and Key Amounts for the 2022 Tax Year. The first part is. Havent Received a Child Tax Credit.

But others are still. The rest of the tax credit worth between 3000 and 3600 per child depending on their age will be paid out when a family files taxes next spring. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

Get your advance payments total and number of qualifying. Of that group anyone who claimed dependents aged 17 and younger as of the end of the end of the 2020 tax year and who tallied equal to or less than 75000 single tax. The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children under age 6 to.

Local time for telephone assistance. Eligible parents can claim a 5000 check divided into two parts. For 2021 eligible parents or guardians can.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. See below for more information. To claim the credit you must be eligible and meet the criteria established under the US.

The Child Tax Credit provides money to support American families. Parents with higher incomes also have two phase-out schemes to worry about for 2021. To reconcile advance payments on your 2021 return.

The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with. The credit amount was increased for 2021. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. The credit will be fully refundable. Here is some important information to understand about this years Child Tax Credit.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Previously the credit was 2000 per child under 17 and. Half of the money will come as six monthly payments and half as a 2021 tax credit.

The agency offers interpreters in more than 350. The enhanced child tax credit which was created as part. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6.

The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct. There are no more advance monthly payments 17-year-olds no longer qualify for the credit and parents or guardians will now need to file a tax return to receive the credit next. The IRS will pay 3600 per child to parents of young children up to age five.

The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could. The Child Tax Credit was expanded under the Key Ways American Rescue Plan in FOUR key ways.

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Who Could See 2 000 In 2022 Fingerlakes1 Com

What Families Need To Know About The Ctc In 2022 Clasp

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

Five Facts About The New Advance Child Tax Credit

The Child Tax Credit Toolkit The White House

How The New Expanded Federal Child Tax Credit Will Work

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The December Child Tax Credit Payment May Be The Last

Child Tax Credit Schedule 8812 H R Block

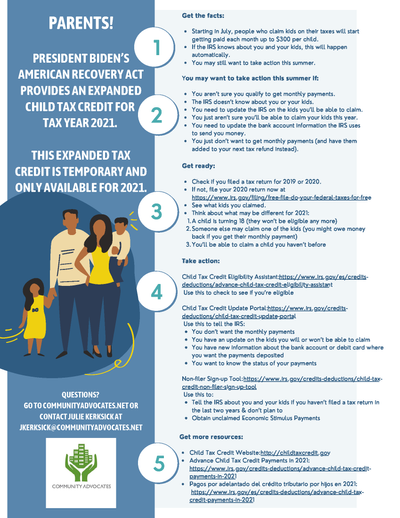

Child Tax Credit What We Do Community Advocates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Toolkit The White House

Irs Child Tax Credit Payments Start July 15

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back